The Single Strategy To Use For Which Of The Following Is An Important Underwriting Principle Of Group Life Insurance?

While 5-to-10 is a great guideline, each household's life insurance coverage requirements are various. If you have more considerable savings and assets, maybe a lower face quantity is right for you. On the flip side, if you have a number of financial obligations you are paying off, then maybe you need to intend for the higher end of that variety.

A life insurance coverage calculator can factor in the ideal financial info about you and your household to offer a more personalized recommendation. Typically held financial obligations include a mortgage, charge card debt, or privately moneyed student loans. These financial obligations may not be forgiven when you die, in which case they should be settled by your estate or cosigner, and in some cases, your partner.

All of this is to state that yes, debts affect your life insurance needs. When filling out a life insurance needs calculator, be sure to consist of all your debts so they will be factored into your policy recommendation. For example, factoring in the rest of your home mortgage principal into your protection requirements will help ensure that your beneficiaries will have a life insurance payout big adequate to help pay off your home or manage the monthly note.

Life pace financial franklin tn insurance coverage is not necessarily one of those areas. The bigger a life insurance policy, the more pricey the premium payments will be, which is why it's crucial to pick a policy that sufficiently covers your requirements however isn't so big that it's a hardship on your spending plan now. There is no wrong amount of protection because some protection is much better than absolutely nothing.

As soon as a policy payout is paid to a recipient, the cash is theirs to do with as they like. The dispersal, a lump amount, is normally tax-free. A recipient could use the money towards financial obligations such as final expenses, large debts, attorney charges, the mortgage, the auto loan, other month-to-month payments, or everyday costs.

In other words, there's no incorrect method to use a life insurance policy payment. That said, talking with your desired recipient about how you hope the cash would be used can help you decide on a policy quantity you're comfortable with. A group life insurance coverage policy through work is an important employee advantage, however if you have a real requirement for protection, the quantity offered complimentary is typically not enough.

How Much Life Insurance Should You Have Fundamentals Explained

In addition, a life insurance coverage policy provided as a worker benefit typically terminates as soon as you separate from your employer. A specific term life insurance policy is independent of your work status. If you have called the same beneficiary on both an employer-provided life insurance policy and a personal term insurance plan, your recipient would get both payments if you were to die, which might be valuable to them as they navigate life without you.

The response is yes. Even if one partner doesn't work outside the home, consider what that individual adds to the family, consisting of child care and household maintenance, and the expenditure to work with somebody to provide those services Find out more if he or she were to die. You and your spouse might also have separate monetary responsibilities.

Some, however not all, spouses carry the same coverage. Protection levels depend on your earnings, financial commitments, and the life insurance coverage premiums you can pay for. A discussion about your present and future financial obligations is part of a clever strategy, and it's an important step toward picking the finest policy for each of you (which of the following best describes term life insurance?).

With time, you may find that your needs alter. Maybe you have actually settled your home or have a robust college savings fund for your kids. It's normally quite basic to lower the quantity of coverage you have as your needs change. At Haven Life, for example, you can lower your life insurance coverage policy any time to assist in saving on life insurance premiums.

Perhaps you've upgraded to a more pricey house and would feel more comfortable with a bigger policy. Maybe your income increased. (Hey, it's nice to dream, right?) Typically, that requires a new application and medical underwriting. ## Armed with an online life insurance calculator and after asking yourself the best concerns, it can be simple to find out the correct amount of life insurance for you, your household and your budget.

Louis Wilson is a self-employed author whose work has actually appeared in a wide range of publications, both online and in print. He frequently composes about travel, sports, pop culture, guys's fashion and grooming, and more. He resides in Austin, Texas, where he has actually established an unbridled enthusiasm for breakfast tacos, with his partner and two kids.

Fascination About What Is Universal Life Insurance

Our company believe browsing choices about life insurance, your personal financial resources and general wellness can be refreshingly basic. Sanctuary Life is a customer centric life insurance company that's backed and entirely owned by Massachusetts Mutual Life Insurance Company (MassMutual). Our company believe browsing choices about life insurance coverage, your personal financial resources and total health can be refreshingly easy.

Sanctuary Life does not endorse the companies, products, services or strategies discussed here, but we hope they can make your life a little less hard if they are a fit for your situation. Sanctuary Life is not authorized to offer tax, legal or investment suggestions. This material is not intended to provide, and must not be counted on for tax, legal, or financial investment advice.

Learn More Haven Term is a Term Life Insurance Coverage Policy (DTC and ICC17DTC in specific states, consisting of NC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and used solely through Haven Life Insurance Agency, LLC. In NY, Haven Term is DTC-NY 1017. In CA, Sanctuary Term is DTC-CA 042017.

Life Insurance Business, Enfield, CT 06082. Policy and rider form numbers and features may vary by state and might not be offered in all states. Our Company license number in https://zenwriting.net/ossidyr0n0/b-table-of-contents-b-a-tz0z California is OK71922 and in Arkansas 100139527. MassMutual is rated by A.M. Finest Business as A++ (Superior; Top category of 15).

MassMutual has actually received various rankings from other ranking firms. Sanctuary Life Plus (Plus) is the marketing name for the Plus rider, which is included as part of the Sanctuary Term policy and provides access to additional services and advantages at no cost or at a discount. The rider is not readily available in every state and goes through change at any time.

For more details about Haven Life Plus, please check out: https://havenlife.com/plus.html Read our disclosures I got quotes from 3 various business. HavenLife did not deviate from the quote till it was provided. 1. Process was simple and fast 2. Gotten continuous assistance 3. Choice was quickly 4. Filling up online was not provided by other 2 companies.

Not known Factual Statements About When Must Insurable Interest Exist For A Life Insurance Contract To Be Valid?

I just have an issue with how insurer rate their customers solely on numbers and not on a total private basis. The experience was perfect and really pleased. I had a great experience with Havelife. Whatever was done online other than the medical examination which only involved a urine sample and bloodwork.

Examine This Report on How Much Is A Unit Of Colonial Penn Life Insurance?

Let's take a look at Sarah from our example earlier and how a survivor benefit of 1012 times her earnings could actually assist her household: Sarah's income is $40,000, and her policy death advantage is $400,000 ($ 40,000 times 10). If Sarah passed away, her family might invest the $400,000 in a shared fund that makes a 10% return.

The interest that Sarah's family might make each year would cover Sarah's income. And the original amount invested could remain there indefinitely as they utilize the interest to help get through life without Sarah. Most significantly, this offers assurance and financial security for Sarah's enjoyed ones during a genuinely difficult time.

Let the mutual funds handle the financial investment part. Ready to begin? The trusted professionals at Zander Insurance can provide you a quick and complimentary quote on a term life policy in a few minutes. Don't put it off another daykeep your momentum going and start now!.

Ask many people what life insurance is, and they'll tell you it's a policy you buy that pays money to your household if you die (how to buy life insurance). Ask them to explain crucial policy features, the various type of policies readily available, how they work and they'll probably try to alter the subject.

All policies are not the exact same. Some offer coverage for your life time and other cover you for a specific variety of years. Some develop cash worths and others do not. Some policies combine different sort of insurance, and others let you change from one kind of insurance coverage to another.

There are 2 basic kinds of life insurance: term insurance and irreversible insurance. Term insurance coverage usually has lower premiums in the early years, but does not develop cash values that you can use in the future. You might combine cash worth life insurance coverage with term insurance coverage for the period of your greatest need for life insurance to replace earnings.

How Does Universal Life Insurance Work Can Be Fun For Everyone

It pays a death advantage only if you die in that term. Term insurance usually provides the largest insurance coverage security for your premium dollar. It generally does not develop money value. You can restore most term insurance coverage for one or more terms, even if your health has actually changed.

Ask what the premiums will be if you continue to renew the policy. Also ask if you will lose the right to renew the policy at a particular age. For a higher premium, some business will offer you the right to keep the policy in force for a guaranteed period at the same price each year.

You might be able to trade lots of term insurance plan for a money worth policy during a conversion period even if you are not in good health. Premiums for the new policy will be higher than you have been spending for the term insurance. Irreversible insurance (such as universal life, variable universal life and entire life) provides long-term monetary security.

, method by which big groups of people adjust the concern of monetary loss from death by dispersing funds to the recipients of those who pass away. Life insurance coverage is most developed in wealthy nations, where it has ended up being a major channel of saving and investment. Upon the death of the guaranteed, the recipient might choose to accept a lump-sum settlement of the face amount of the life insurance policy, get the profits over a given duration, leave the cash with the insurance company temporarily and draw interest on it, or use it to purchase an annuity that assurances regular payments for life.

Under term insurance coverage contracts, a set amount of protection, such as $50,000 or $500,000, is provided for a given time period. The premiums on such policies tend to increase with age, indicating that premium costs will be higher for a 60-year-old than for a 30-year-old. This holds true for new policies as well as renewals of existing policies.

A lot of entire life contracts likewise collect a money value that is paid when the contract grows or is given up; the money worth is less than the policy's face value. While the repaired premiums represent a way of managing expenses in the future, the set payment uses no chance to protect versus inflation.

The Ultimate Guide To How To Find A Life Insurance Policy Exists

Subscribe today Variable life insurance is similar to entire life insurance coverage in that the insured obtains a fixed-premium life insurance coverage policy that attends to a minimum survivor benefit. It varies, nevertheless, because the insured's policy holdings are allocated to variable financial investment accounts (i.e., portfolios that invest in securities or bonds) that run similar to mutual funds.

If they perform poorly, they can lead to a loss. Income from the accounts can be used to pay annual premiums or can be contributed to the value of the policy.Universal life insurance policies are identified by flexible premiums and adjustable Hop over to this website levels of protection. Although the protection is long-term (it does not expire, as does term insurance coverage), the worth of the policy may differ according to the performance of the financial investments on which it is based.

An annual report is provided to the insurance policy holder that reveals the status of the policy, including the death benefit, the amount of insurance in force, the cash value and surrender worth, and any transactions made within the policy during the previous year.

The Federal Government established the Federal Personnel' Group Life Insurance (FEGLI) Program on August 29, 1954 (what is permanent life insurance). It is the largest group life insurance program on the planet, covering over 4 million Federal workers and retirees, in addition to a lot of their member of the family. A lot of workers are qualified for FEGLI protection.

As such, it does not develop any cash value or paid-up worth. It includes Basic life insurance protection and three choices - how life insurance works. https://www.youtube.com/channel/UCRFGul7bP0n0fmyxWz0YMAA Most of the times, if you are a new Federal employee, you are automatically covered by Standard life insurance and your payroll office deducts premiums from your paycheck unless you waive the protection.

You need to have Fundamental insurance in order to elect any of the options. Unlike Basic, enrollment in Optional insurance is manual-- you should take action to choose the choices. The expense of Fundamental insurance coverage is shared between you and the Government. You pay 2/3 of the overall expense and the Government pays 1/3.

Some Ideas on What Is Life Insurance For You Should Know

You pay the complete cost of Optional insurance, and the cost depends upon your age. The Office of Federal Employees' Group Life Insurance Coverage (OFEGLI), which is a personal entity that has an agreement with the Federal Government, processes and pays claims under the FEGLI Program. The FEGLI Calculator enables you to identify the face value of different mixes of FEGLI coverage; determine premiums for the different mixes of protection; see how choosing various Choices can change the quantity of life insurance and the premium withholdings; and see how the life insurance coverage brought into retirement will alter in time.

The 5-Second Trick For What Type Of Life Insurance Incorporates Flexible Premiums And An Adjustable Death Benefit?

Let's take a look at Sarah from our example earlier and how a death advantage of 1012 times her earnings might truly assist her family: Sarah's income is $40,000, and her policy death benefit is $400,000 ($ 40,000 times 10). If Sarah died, her family could invest the $400,000 in a mutual fund that makes a 10% return.

The interest that Sarah's household might make each year would cover Sarah's wage. And the initial amount invested might stay there indefinitely as they use the interest to assist make it through life without Sarah. Most significantly, this provides peace of mind and monetary security for Sarah's loved ones throughout a really challenging time.

Let the shared funds handle the investment part. All set to begin? The relied on specialists at Zander Insurance can provide you a quick and free quote on a term life policy in a couple of minutes. Do not put it off another daykeep your momentum going and get begun now!.

Ask many people what life insurance is, and they'll tell you it's a policy you purchase that pays money to your family if you pass away (how many life insurance policies can you have). Ask them to explain essential policy features, the different kinds of policies readily available, how they work and they'll probably attempt to alter the topic.

All policies are not the very same. Some offer protection for your lifetime and other cover you for a specific variety of years. Some build up cash worths and others do not. wesley financial group Some policies integrate different type of insurance coverage, and others let you change from one sort of insurance to another.

There are 2 basic kinds of life insurance coverage: term insurance and irreversible insurance coverage. Term insurance usually has lower premiums in the early years, but does not construct up money worths that you can utilize in the future. You may combine money value life insurance http://www.williamsonherald.com/communities/franklin-based-wesley-financial-group-named-in-best-places-to-work/article_d3c79d80-8633-11ea-b286-5f673b2f6db6.html coverage with term insurance for the period of your greatest need for life insurance coverage to replace income.

The 10-Minute Rule for How Much Life Insurance Do I Need

It pays a death benefit only if you pass away in that term. Term insurance coverage typically provides the largest insurance coverage defense for your premium dollar. It generally does not construct up cash worth. You can restore most term insurance policies for one or more terms, even if your health has changed.

Ask what the premiums will be if you continue to restore the policy. Also ask if you will lose the right to restore the policy at a specific age. For a higher premium, some companies will give you the right to keep the policy in force for a guaranteed duration at the exact same rate each year.

You may have the ability to trade lots of term insurance coverage policies for a money worth policy throughout a conversion duration even if you are not in excellent health. Premiums for the new policy will be higher than you have been paying for the term insurance coverage. Irreversible insurance (such as universal life, variable universal life and whole life) provides long-term monetary security.

, method by which large groups of people equalize the problem of financial loss from death by dispersing funds to the beneficiaries of those who pass away. Life insurance is most established in wealthy countries, where it has actually become a major channel of saving and financial investment. Upon the death of the guaranteed, the recipient might select to accept a lump-sum settlement of the face amount of the life insurance policy, receive the proceeds over an offered duration, leave the cash with the insurance provider momentarily and draw interest on it, or use it to acquire an annuity that guarantees regular payments for life.

Under term insurance coverage contracts, a set quantity of coverage, such as $50,000 or $500,000, is released for a given period of time. The premiums on such policies tend to increase with age, indicating that premium costs will be greater for a 60-year-old than for a 30-year-old. This holds true for brand-new policies as well as renewals of existing policies.

A lot of whole life agreements likewise collect a money value that is paid when the agreement matures or is surrendered; the money value is less than the policy's stated value. While the repaired premiums represent a method of managing expenses in the future, the set payment provides no opportunity to secure versus inflation.

The Single Strategy To Use For What Is The Purpose Of Life Insurance

Subscribe today Variable life insurance resembles whole life insurance because the insured obtains a fixed-premium life insurance policy that offers a minimum survivor benefit. It varies, however, because the insured's policy holdings are assigned to variable financial investment accounts (i.e., portfolios that buy securities or bonds) that operate just like mutual funds.

If they perform poorly, they can lead to a loss. Income from the accounts can be utilized to pay annual premiums or can be contributed to the value of the policy.Universal life insurance policies are distinguished by flexible premiums and adjustable levels of coverage. Although the coverage is long-term (it does not expire, as does term insurance), the value of the policy may differ according to the efficiency of the financial investments on which it is based.

An annual report is provided to the policyholder that shows the status of the policy, consisting of the death advantage, the amount of insurance coverage in force, the money value and surrender value, and any deals made within the policy during the previous year.

The Federal Government developed the Federal Personnel' Group Life Insurance (FEGLI) Program on August 29, 1954 (how much life insurance do i need). It is the largest group life insurance program in the world, covering over 4 million Federal workers and retirees, along with a number of their relative. The majority of workers are eligible for FEGLI protection.

As such, it does not develop any money value or paid-up value. It consists of Standard life insurance protection and 3 alternatives - what is a whole life insurance policy. In most cases, if you are a new Federal employee, you are instantly covered by Standard life insurance coverage and your payroll workplace subtracts premiums from your paycheck unless you waive the coverage.

You must have Fundamental insurance coverage in order to choose any of the choices. Unlike Basic, enrollment in Optional insurance coverage is not automated-- you must act to choose the choices. The expense of Basic insurance is shared in between you and the Government. You pay 2/3 of the overall cost and the Government pays 1/3.

Some Ideas on Which Parts Of A Life Insurance Policy Are Guaranteed To Be True? You Should Know

You pay the complete cost of Optional insurance, and the expense depends upon your age. The Office of Federal Employees' Group Life Insurance (OFEGLI), which is a private entity that has a contract with the Federal Government, processes and pays claims under the FEGLI Program. The FEGLI Calculator permits you to determine the face value of different mixes of FEGLI coverage; compute premiums for the numerous mixes of coverage; see how selecting different Choices can change the amount of life insurance and the premium withholdings; and see how the life insurance coverage carried into retirement will change in time.

Little Known Facts About What Does Liquidity Refer To In A Life Insurance Policy.

Table of ContentsGetting The Which Of The Following Is An Example Of Liquidity In A Life Insurance Contract To WorkGetting My What Happens If You Stop Paying Whole Life Insurance Premiums To WorkGetting My How To Become A Life Insurance Agent To Work3 Easy Facts About Why Life Insurance ExplainedThe Best Strategy To Use For How Much Is A Unit Of Colonial Penn Life Insurance?

Life insurance coverage can pay funeral service and burial costs, probate and other estate administration costs, financial obligations and medical expenditures not covered by medical insurance. Even those with no other west land financial assets to pass on, can create an inheritance by buying a life insurance policy and calling their heirs as recipients. Life insurance coverage benefits can spend for estate taxes so that beneficiaries will not have to liquidate other properties or take a smaller inheritance.

By making a charity the beneficiary of their life insurance coverage policies, individuals can make a much bigger contribution than if they donated the cash equivalent of the policy's premiums. Some types of life insurance coverage create a cash worth that, if not paid out as a death benefit, can be borrowed or withdrawn on the owner's request.

Additionally, the interest credited is tax deferred (and tax exempt if the cash is paid as a death claim). There are two significant types of life insuranceterm and entire life. Term insurance coverage is the most basic kind of life insurance. It pays just if death happens throughout the regard to the policy, which is typically from one to 30 years.

There are 2 standard types of term life insurance coverage policieslevel term and reducing term. Level term implies that the survivor benefit stays the very same throughout the duration of the policy. Reducing term indicates that the survivor benefit drops, typically in 1 year increments, throughout the policy's term. Whole life or long-term insurance pays a death advantage whenever the insurance policy holder dies.

Get This Report on How Much Is Whole Life Insurance

When it comes to standard whole life, both the survivor benefit and the premium are developed to remain the same (level) throughout the life of the policy. The expense per $1,000 of advantage increases as the insured individual ages, and it obviously gets extremely high when the insured lives to 80 and beyond.

By law, when these "overpayments" reach a specific quantity, they need to be offered to the insurance policy holder as a cash value if he or she decides not to continue with the original plan. The cash value is an option, not an additional, advantage under the policy. Universal life, also called adjustable life, allows more versatility than conventional entire life policies.

After cash has collected in the account, the insurance policy holder will also have the option of altering premium paymentsproviding there is enough cash in the account to cover the costs. Variable life policies combine death defense with a cost savings account that can be invested in stocks, bonds and money market shared funds.

If investments do not carry out well, the cash value and survivor benefit might decrease. Some policies, nevertheless, warranty that the death advantage will not fall below a minimum level (what does term life insurance mean). Another version, universal variable life, combines the functions of variable and universal life policies. It has the financial investment risks and rewards characteristic of variable life insurance coverage, coupled with the ability to adjust premiums and death benefits that is characteristic of universal life http://jaredwcra172.fotosdefrases.com/not-known-factual-statements-about-what-is-the-best-life-insurance insurance.

Getting The When Should I Get Life Insurance To Work

Many or all of the products featured here are from our partners who compensate us. This may affect which products we discuss and where and how the product appears on a page. Nevertheless, this does not influence our assessments. Our viewpoints are our own. Life insurance coverage is a contract in between you and an insurance company.

In exchange, the company pays a death advantage to your beneficiaries when you die. There are basically two kinds of life insurance: term life and long-term life. Term life covers you for a fixed amount of time while permanent life insurance coverage covers you until the end of your life. Generally, term life insurance coverage is cheaper to buy than irreversible life.

Term life policies have no value if you outlive the agreement. Initially developed to assist cover burial expenses and take care of widows and orphans, life insurance is now a flexible and effective monetary product. More than half of Americans have some sort of life insurance coverage, according to insurance research company LIMRA.

We'll be taking a look at specific policies, not the group life insurance coverage frequently issued through work. Life insurance policies can differ widely. There's life insurance coverage for households, high-risk purchasers, couples and lots of other particular groups. Even with all those differences, the majority of policies have some typical characteristics. are the payments you make to the insurer.

What Is Universal Life Insurance Can Be Fun For Everyone

With an irreversible policy, you'll likewise have the ability to pay cash into a cash-value account. are the people who receive cash when the covered person dies. Choosing life insurance coverage beneficiaries is an essential step in planning the effect of your life insurance coverage. Recipients are often spouses, children or parents, but you can choose anybody you like.

You pick a cash value when you purchase a policy, and the amount is in some cases but not constantly a fixed worth. Permanent life insurance can likewise pay additional cash if the money account has grown and if you choose particular choices for your policy. are alternatives you can contribute to a life insurance policy.

By spending for a rider, you can include those and other functions to your policy. Like all insurance, life insurance coverage was developed to solve a monetary issue. Life insurance is very important since when you die, your income vanishes. If you have a spouse, kids or anyone based on you financially, they're going to be left without assistance.

That can suggest your spouse, kid or family members will need to spend for burial and other end-of-life costs. As you think of the amount of life insurance protection you need, consider your beneficiaries and what they'll require. If nobody depends on your income and your funeral service costs won't harm anyone's financial resources, life insurance coverage may be a thing you can avoid.

Some Of What Is The Purpose Of A Disclosure Statement In Life Insurance Policies

The quantity of life insurance you require depends on what you're attempting to do. If you're simply covering end-of-life expenditures, you will not need as much as if you're attempting to replace lost earnings. The calculator listed below can help you approximate the overall protection you might need. If you have an interest in an irreversible policy (more on these listed below), you ought to also get in touch with a fee-only monetary consultant.

Term life insurance is protection that lasts for a period of time selected at purchase. This kind of life insurance coverage commonly covers 10-, 20- and even 30-year durations (what is life insurance). If you pass away throughout the covered period, the policy will pay your beneficiaries the amount stated in the policy. If you don't die throughout that time frame, no one earns money.

It's likewise a momentary solution. It exists for the same factor short-lived tattoos and hair dyes do in some cases a bit is long enough. Reasons you may want term life insurance consist of: You wish to ensure your child can go to college, even if you pass away. You have a home mortgage that you don't want to saddle your partner with after your death.

There are some variations on typical term life insurance coverage policies. Convertible policies permit you to transform them to permanent life policies at a higher rate, allowing for longer, more versatile protection. Decreasing term life policies have a survivor benefit that declines gradually, often associated home loans or big debts that are gradually paid off.

<h1 style="clear:both" id="content-section-0">About What Is The Purpose Of Life Insurance</h1>

Table of ContentsHow To Find Out If Life Insurance Policy Exists Things To Know Before You BuyHow What Is Credit Life Insurance can Save You Time, Stress, and Money.Getting My How Much Is Life Insurance A Month To WorkHow How To Choose Life Insurance can Save You Time, Stress, and Money.Not known Incorrect Statements About How Long Does It Take To Cash Out Life Insurance Policy

Life insurance can pay funeral service and burial expenses, probate and other estate administration expenses, debts and medical costs not covered by health insurance coverage. Even those with no other possessions to hand down, can create an inheritance by purchasing a life insurance coverage policy and naming their successors as beneficiaries. Life insurance coverage advantages can spend for estate taxes so that beneficiaries will not need to liquidate other properties or take a smaller sized inheritance.

By making a charity the beneficiary of their life insurance coverage policies, people can make a much bigger contribution than if they donated the money equivalent of the policy's premiums. Some types of life insurance produce a cash value that, if not paid out as a death advantage, can be obtained or withdrawn on the owner's request.

Moreover, the interest credited is tax deferred (and tax exempt if the cash is paid as a death claim). There are 2 significant kinds of life insuranceterm and whole life. Term insurance coverage is the easiest type of life insurance coverage. It pays only if death happens during the term of the policy, which is typically from one to thirty years.

There are 2 standard types of term life insurance coverage policieslevel term and reducing term. Level term suggests that the death benefit remains the exact same throughout the period of the policy. Decreasing term indicates that the death advantage drops, usually in 1 year increments, over the course of the policy's term. Whole life or permanent insurance pays a survivor benefit whenever the policyholder dies.

The Ultimate Guide To How Can Health Insurance Status Be Affected By Women's Different Stages Of Life?

When it comes to conventional entire life, both the death advantage and the premium are designed to remain the very same (level) throughout the life of the policy. The expense per $1,000 of advantage boosts as the guaranteed individual ages, and it clearly gets very high when the guaranteed lives to 80 and beyond.

By law, when these "overpayments" reach a particular quantity, they need to be offered to the policyholder as a money value if she or he decides not to continue with the original strategy. The money worth is an option, not an additional, advantage under the policy. Universal life, likewise called adjustable life, enables more flexibility than standard entire life policies.

After cash has accumulated in the account, the policyholder will likewise have the alternative of modifying premium paymentsproviding there is enough money in the account to cover the expenses. Variable life policies combine death security with a savings account that can be bought stocks, bonds and cash market mutual funds.

If investments do not perform well, the cash value and death advantage may reduce. Some policies, however, warranty that the survivor benefit will not sirius advertisement fall below a minimum level (how much does life insurance cost). Another variation, universal variable life, integrates the features of variable and universal life policies. It has the investment dangers and rewards characteristic of variable life insurance coverage, paired with the ability to adjust premiums and death benefits that is particular of universal life insurance coverage.

3 Easy Facts About What Is Universal Life Insurance Shown

Numerous or all https://postheaven.net/idrose15d3/b-table-of-contents-b-a-3wnn of the products included here are from our partners who compensate us. This might influence which items we write about and where and how the item appears on a page. Nevertheless, this does not influence our evaluations. Our opinions are our own. Life insurance is a contract in between you and an insurance company.

In exchange, the business pays a survivor benefit to your beneficiaries when you pass away. There are basically 2 kinds of life insurance coverage: term life and permanent life. Term life covers you for a fixed amount of time while irreversible life insurance coverage covers you up until the end of your life. Normally, term life insurance is more affordable to purchase than permanent life.

Term life policies have no value if you outlast the agreement. Initially developed to assist cover burial costs and take care of widows and orphans, life insurance coverage is now a flexible and powerful monetary item. Majority of Americans have some sort of life insurance coverage, according to insurance coverage research company LIMRA.

We'll be looking at private policies, not the group life insurance commonly issued through work. Life insurance policies can differ widely. There's life insurance coverage for families, high-risk purchasers, couples and numerous other particular groups. Even with all those differences, most policies have some typical qualities. are the payments you make to the insurance provider.

Things about What Kind Of Special Need Would A Policyowner Require With An Adjustable Life Insurance Policy?

With an irreversible policy, you'll likewise have the ability to pay cash into a cash-value account. are the people who receive cash when the covered individual passes away. Choosing life insurance beneficiaries is an important action in preparing the effect of your life insurance coverage. Recipients are typically partners, kids or parents, however you can pick anybody you like.

You choose a money worth when you buy a policy, and the amount is often however not always a repaired value. Irreversible life insurance coverage can also pay additional cash if the cash account has grown and if you pick specific choices for your policy. are choices you can contribute to a life insurance coverage policy.

By spending for a rider, you can include those and other functions to your policy. Like all insurance coverage, life insurance coverage was designed to resolve a financial issue. Life insurance coverage is very important because when you pass away, your income disappears. If you have a spouse, kids or anybody based on you financially, they're going to be left without support.

That can indicate your spouse, child or family members will have to spend for burial and other end-of-life expenses. As you think about the quantity of life insurance coverage you need, consider your beneficiaries and what they'll require. If nobody depends upon your earnings and your funeral service expenditures will not harm anyone's financial resources, life insurance coverage might be a thing you can skip.

Things about How To Choose Life Insurance

The amount of life insurance you require depends upon what you're attempting to do. If you're simply covering end-of-life costs, you will not need as much as if you're trying to replace lost income. The calculator listed below can assist you estimate the total coverage you might need. If you have an interest in an irreversible policy (more on these below), you must also get in touch with a fee-only monetary advisor.

Term life insurance is protection that lasts for an amount of time selected at purchase. This type of life insurance typically covers 10-, 20- and even 30-year periods (what is voluntary life insurance). If you pass away throughout the covered period, the policy will pay your recipients the amount stated in the policy. If you don't pass away during that time frame, nobody gets paid.

It's also a temporary option. It exists for the same reason momentary tattoos and hair dyes do often a bit is long enough. Reasons you may desire term life insurance coverage include: You wish to make sure your child can go to college, even if you pass away. You have a home mortgage that you don't desire to saddle your partner with after your death.

There are some variations on typical term life insurance coverage policies. Convertible policies permit you to convert them to irreversible life policies at a greater rate, enabling longer, more versatile protection. Decreasing term life policies have a survivor benefit that decreases in time, often lined up with home mortgages or big debts that are slowly paid off.

<h1 style="clear:both" id="content-section-0">The smart Trick of What Is Cash Value Life Insurance That Nobody is Discussing</h1>

Table of ContentsSome Known Questions About What Is Life Insurance Used For.Things about How Much Life Insurance Should I BuyThe Best Strategy To Use For Which Is Better Term Or Whole Life Insurance?Things about How Much Life Insurance Do I Really Need

A life insurance coverage policy is an agreement with an insurer. In exchange for premium payments, the insurance provider offers a lump-sum payment, referred to as a death benefit, to recipients upon the insured's death. Typically, life insurance coverage is picked based upon the requirements and objectives of the owner. Term life insurance coverage generally supplies security for a set duration of time, while permanent insurance, such as whole and universal life, offers life time protection.

1 There are lots of ranges of life insurance. A few of the more typical types are discussed listed below. Term life insurance coverage is created to offer financial security for a specific period of time, such as 10 or twenty years. With traditional term insurance, the premium payment quantity remains the exact same for the coverage duration you select.

Term life insurance is generally less pricey than long-term life insurance. Term life insurance coverage earnings can be utilized to replace lost possible income during working years. This can supply a security net for your recipients and can also assist ensure the family's monetary goals will still be metgoals like settling a home loan, keeping an organisation running, and paying for college.

Universal life insurance is a kind of permanent life insurance developed to supply life time coverage. Unlike entire life insurance, universal life insurance coverage policies are versatile and may allow you to raise or reduce your premium payment or protection amounts throughout your lifetime. In addition, due to its life time protection, universal life usually has higher premium payments than term.

Another typical use is long term earnings replacement, where the requirement extends beyond working years. Some universal life insurance product develops concentrate on supplying both survivor benefit coverage and building money value while others concentrate on offering guaranteed death advantage coverage. Whole life insurance coverage is a type of permanent life insurance developed to supply lifetime protection.

Not known Details About What Does The Ownership Clause In A Life Insurance Policy State?

Policy premium payments are normally fixed, and, unlike term, entire life has a money value, which works as a cost savings component and might collect tax-deferred gradually. Whole life can be used as an estate planning tool to assist preserve the wealth you prepare to transfer to your recipients. Income replacement during working years Wealth transfer, earnings security and some designs concentrate on tax-deferred wealth accumulation Wealth transfer, preservation and, tax-deferred wealth build-up Created for a specific period (typically a number of years) Versatile; normally, for a life time For a lifetime Generally less expensive than permanent Usually more expensive than term Generally more costly than term Typically repaired Flexible Generally set Yes, usually earnings tax-free Yes, generally earnings tax-free Yes, generally income tax-free No No2 No No Yes Yes Yes, Fidelity Term Life Insurance3 Yes, Universal Life Insurance coverage, primarily concentrated on death advantage defense No, traditional Whole Life Insurance coverage is not presently offered Insurers use rate classes, or risk-related categories, to determine your premium payments; these classifications don't, nevertheless, impact the length or amount of coverage.

Tobacco usage, for example, would increase threat and, for that reason cause your premium payment to be greater than that of someone who does not utilize tobacco.

So you have actually got your house and auto insurance coverage established and crossed off your list. However what about life insurance coverage? If you haven't navigated to it yet, you're not alone: Last year, just 60% of Americans had some type of life insurance in place.1 Possibly getting life insurance coverage is already on your radar.

So here's what you require to understand about life insurancehow it works, what it costs, and which type is right for you (how does life insurance work). Life insurance is an arrangement between you and an insurance coverage service provider that, in exchange for your monthly payments, the insurance company will pay an amount of cash to your loved ones when you die.

However concentrate on this: You buy life insurance not due to the fact that you're going to die but due to the fact that those you enjoy are going to liveand you desire them to be economically safe and secure after you're gone. Life insurance can cover loss of earnings, funeral service expenditures, financial obligation and other monetary needs that might turn up after you die.

Not known Facts About How To Sell Life Insurance Successfully

Checking out a life insurance agreement can feel like the most uninteresting thing in the world, right? However you truly just need to understand a couple of common life insurance terms to help you understand how it works: the agreement in between you and the insurance provider the regular monthly or annual payments you make to own the insurance coverage policy the owner of the policy, which would usually be you (the one insured), however you could purchase a policy for another individual the cash provided when you die individuals you pick to receive the death benefit of your policy (like your spouse or children, but it can be anyone you call) In a nutshell, when you (the policyholder) start paying your premiums, the insurance company ensures they'll pay the survivor benefit to your beneficiaries when you pass away.

There are two main types of life insurance: one that lasts for a set variety of years (term life insurance coverage) and one that lasts through your entire life (long-term life insurance). Term life insurance supplies coverage for a specific amount of time. If you pass away at any time during this term, your recipients will get the death benefit from the policy.

Permanent life insurance lasts throughout your entire lifetime. It can be found in the form of entire life, universal life or variable life insuranceeach differing slightly from the other. Besides the insuring-your-life part, irreversible insurance includes an investing-your-money piece to your policy called money value. The insurance business takes a portion of your premium to begin a financial investment account.

Almost everybody needs life insurance coverage. No matter what stage of life you're at, life insurance comprises a vital part of your monetary security. Let's take a look to see where you may fit in: You may have some credit card and trainee loan debts that will require to be paid after death.

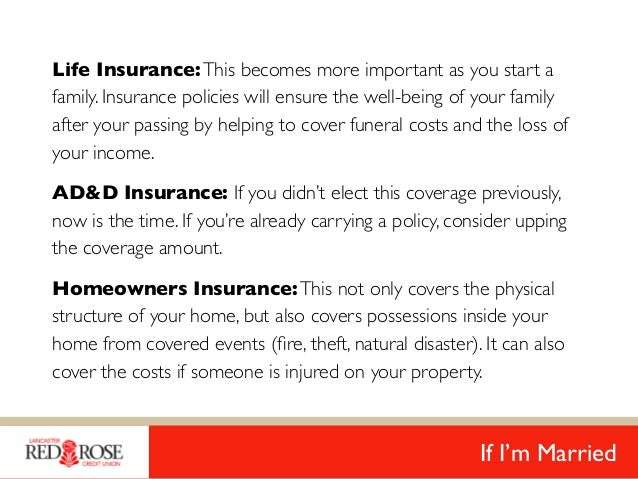

And if you have actually signed up for a group life insurance coverage plan through your employer, there might not be an urgent need to secure your own policyyet! Congratulations! You have actually just started your brand-new life together, and that indicates you're there for one another through thick and thin. You should both have a life insurance plan in location.

3 Easy Facts About Which Of The Following Is An Important Underwriting Principle Of Group Life Insurance? Explained

Get enough life insurance coverage to make certain they're taken care of. If you have kids, both you and your spouse requirement to be covered, even if among you does not work outside of the house. The lack of a stay-at-home parent would greatly affect the family spending plan. Childcare expenses aren't low-cost these days.

Trust usyou desire (and require) this peace of mind. At this point, you may already have significant retirement savings in location. You might even be well on your method to becoming self-insured and not require any life insurance coverage. That's a fantastic place to be! However let's say you're still paying off your home and trying to include to your retirement cost savings.